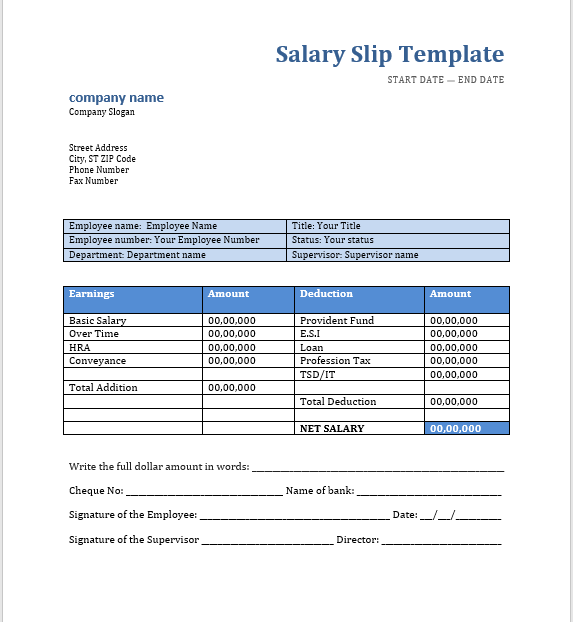

1600 per month or based on the actual amount in your salary slip. Taxability: The income tax allows a maximum exemption of Rs. The employer calculates this allowance based on employee attendance. Conveyance Allowanceĭescription: Allowance or money to compensate for an employee’s travel expenses between their residence and workplace is Conveyance Allowance. Taxability: This allowance is exempted up to a certain limit from income tax. For employees in a metro city, it is 50% of the basic pay whereas employees of a non-metro city it is 40% of the basic pay. It is decided based on different criteria like the city of residence and salary grade. House Rent Allowance (HRA)ĭescription: House Rent Allowance is the amount allocated by an employer to the employee as a portion of their CTC salaries. Taxability: Dearness Allowance is fully taxable for individuals who are salaried employees. DA (Dearness Allowance) is 4% to 10% of basic pay depending on the contract.

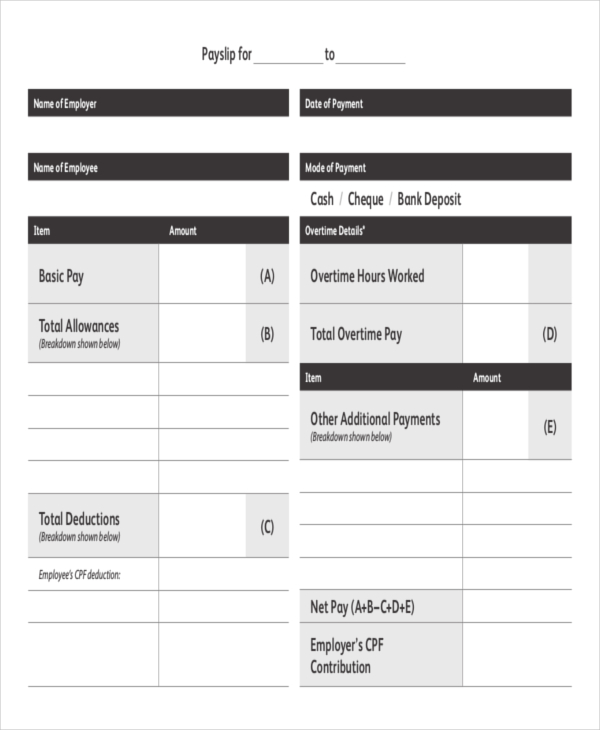

Government employees, public sector employees, and pensioners get to DA. Dearness Allowanceĭescription: In India, Pakistan, and Bangladesh, employers provide Dearness Allowance A as the cost of living adjustment allowance. In addition to the basic salary, Allowances are extra financial benefits that employers provide to their employees. Taxability: Basic salary is 100% taxable if it crosses the Income Tax Slabs. Usually, the basic salary is 40-50% of CTC. Basic Salaryĭescription: Basic salary is the fixed amount to be paid to an employee addition of any allowances or subtraction any deductions. There are three major components of the Salary: Basic Pay, Allowances, and Deductions. You just need to enter the payroll data of your employees and print the salary slip. We have created the 9 ready-to-use Salary Slip Templates with predefined formulas. Salary Slip is a payroll document that contains details of salary paid to any employee which include basic salary, allowances, deductions, attendance, leave record, etc.

0 kommentar(er)

0 kommentar(er)